2 rows The family leave credit is also calculated using the average daily self-employment income. Max refund is guaranteed and 100 accurate.

What Self Employed Workers Need To Know About The Coronavirus Stimulus Package The New York Times

Ad Fill Sign Email DOL FS 28 More Fillable Forms Register and Subscribe Now.

. Because the Service did not. This credit is a max of 200 per day with a max credit of 12000. On March 18 the Families First Coronavirus Response Act FFCRA was passed which includes relief for self-employed and small businesses in the form of refundable sick leave and family leave tax credits.

As to the totally separate issue of whether a sole proprietor which is only one type of self-employed person can pay himselfherself wages I dont think so but have not really looked at. Free means free and IRS e-file is included. Maximum 200 family leave credit per day and 2000 in the aggregate.

The FFCRA passed in March 2020 allows eligible self-employed individuals who due to COVID-19 are unable to work or telework for reasons relating to their own health or to care for a family member to claim refundable tax credits to offset their federal income tax. Family leave credit 23 of the paid sick leave credit. This credit is limited to 50 days and can be taken along with the Sick Leave Credit.

But did you know that if you were self-employed and unable to work due to COVID-19 you may also be. Self-Employed Individuals Can Claim COVID-19 Sick and Family Leave Tax Credits. There is no requirement for a self-employed person to pay himself wages in order to take advantage of claim Self Employed Family Leave Credit.

Furthermore the Services guidance is not legally binding and we are seeing all agencies making changes from-time-to-time in their guidance. Ad All Major Tax Situations Are Supported for Free. During the second and third quarters of 2021 the qualified family leave equivalent amount with respect to an eligible self-employed individual is an amount equal to the number of days up to 60 that the self-employed individual cannot perform services for which that individual would be entitled to paid family leave if the individual were employed by an Eligible.

Maximum 511 paid sick leave credit per day and 5110 in the aggregate. To qualify for this credit a self-employed individuals son or daughter must be under the age of 18 OR incapable of self-care due to mental or physical disability. The Family Leave Credit is an additional credit for individuals who were unable to work because they were caring for a child whose school or place of care was unavailable because of COVID-19.

Under the expanded Family and Medical Leave Act FMLA provision of the FFCRA you would be eligible for qualified family leave for each day that you were unable to work because you were caring for someone else impacted by COVID-19 up to 10 days or for each day you were unable to work because your childs school or child care provider was closed or unavailable due. The qualified sick leave and family leave tax credits are being provided to eligible self-employed individuals who are not able to receive paid sick leave or. However any days used for the Sick Leave Credit are excluded from the calculation of the Family Leave Credit.

Self employed sick leave credit family leave credit No. The Families First Coronavirus Response Act FFCRA entitles employers to payroll tax credits to cover the cost of leave for their employees who contract COVID-19. In the News Tax.

Per day earnings from self-employment total self-employment earnings 260 days. Ad DoL WH-380-F More Fillable Forms Register and Subscribe Now. February 21 2021 823 AM.

For self-employed persons granting a credit of emergency family leave and emergency paid sick leave are helpful but further guidance from the Service may be necessary. Start Your Tax Return Today. The American Rescue Plan Act of 2021 enacted on March 11 2021 ARP provides that certain self-employed individuals can claim credits for up to 10 days of paid sick leave and up to 60 days of paid family leave if they are unable to work or telework due to circumstances related to coronavirus.

Can Self Employed Workers Receive Tax Credits For Covid 19 Goodrx

California Paid Family Leave Benefits 2022 A How To Guide

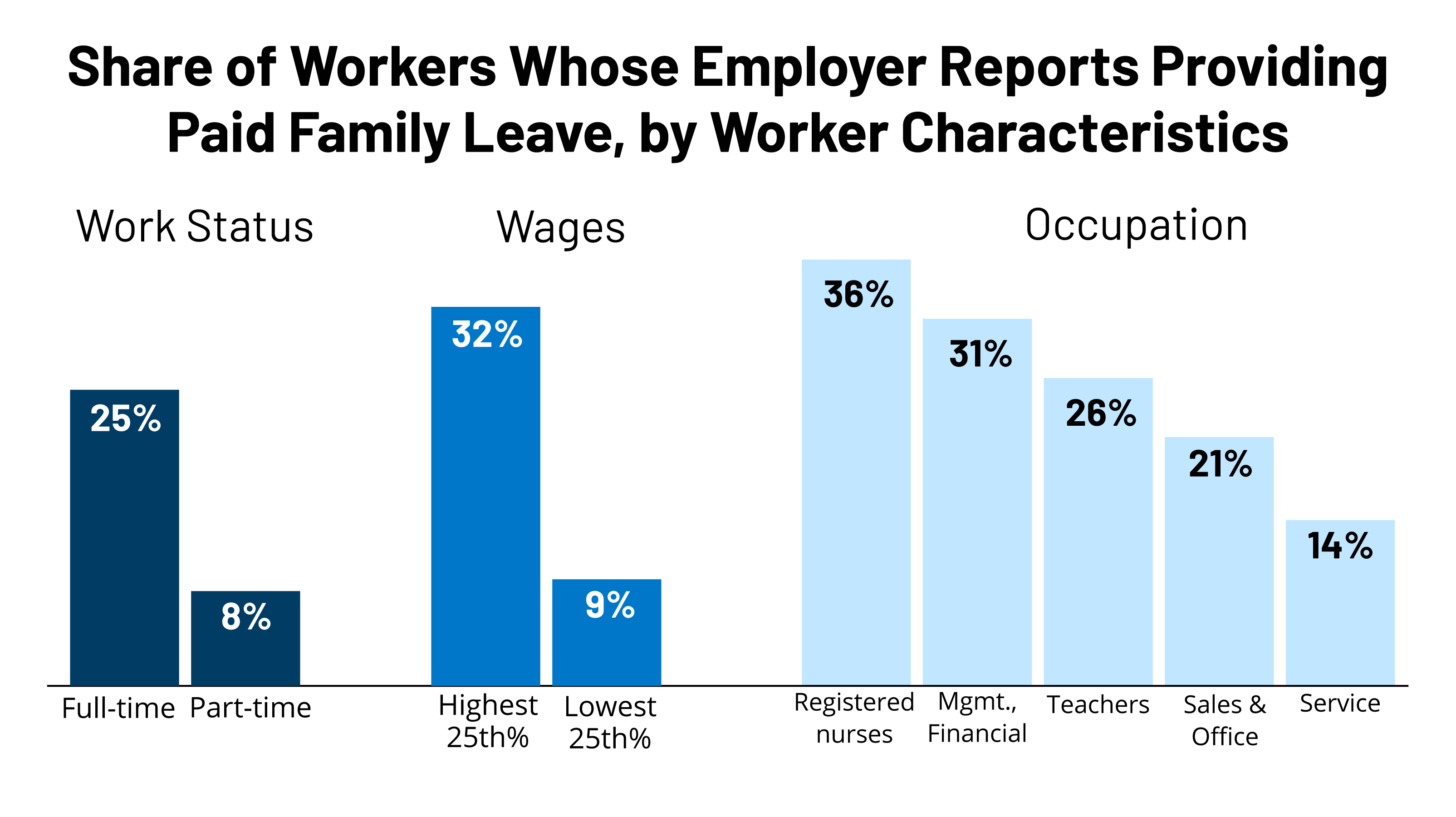

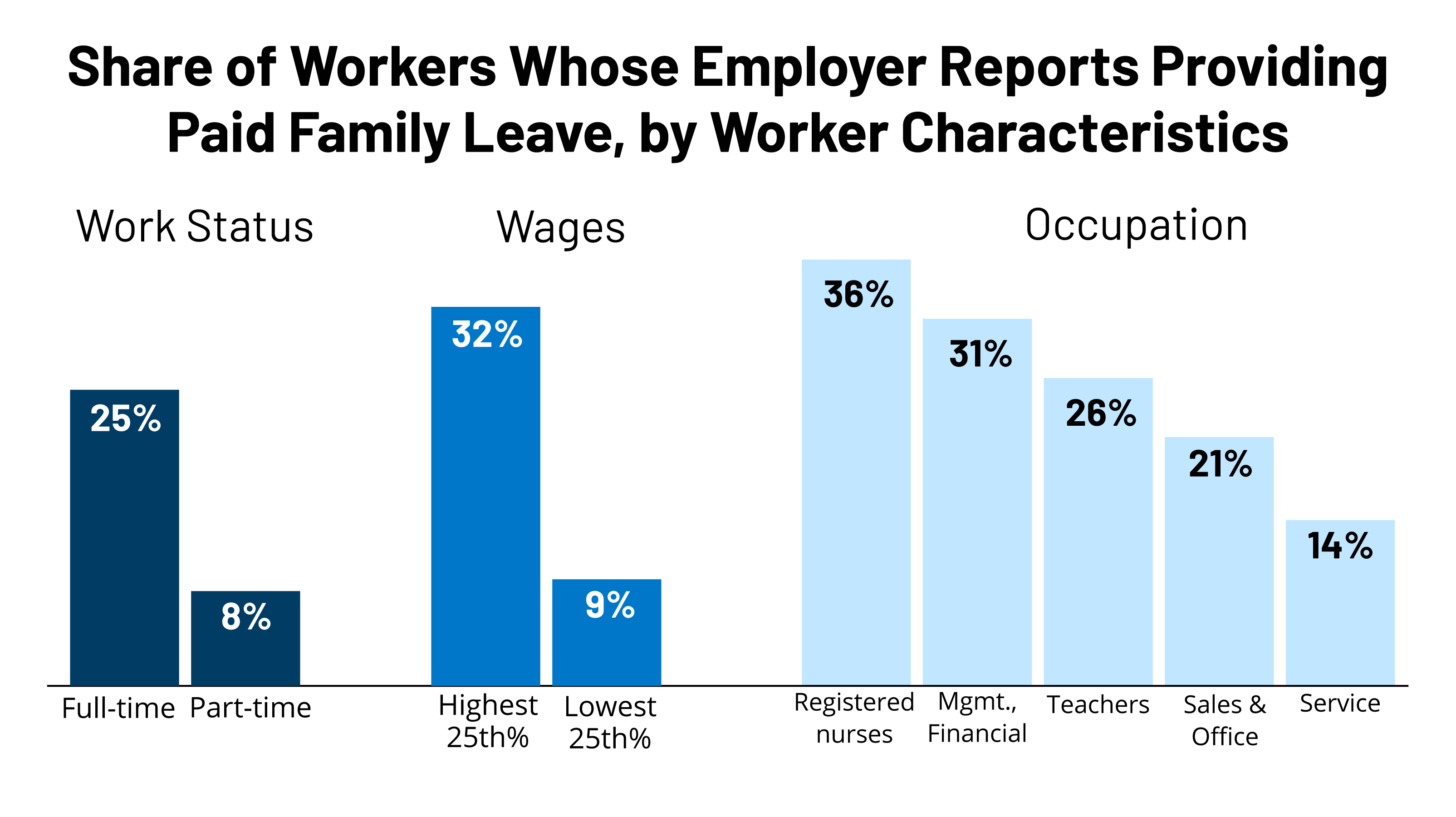

Universal Paid Family And Medical Leave Under Consideration In Congress Kff

Freelancer S Guide To Using Your Paid Leave Tax Credit A Better Balance

What Self Employed Workers Need To Know About The Coronavirus Stimulus Package The New York Times

/selfemployed.GettyImages-875247422_1800-c4c3d0d3d014465a8bfc90719a01af67.png)

0 comments

Post a Comment